Table of Contents

California Earned Income Tax Credit - Ftb.ca.gov in San-Angelo-Texas

The catch here is that this credit is most beneficial for people who expect to owe money — and that's because it can only lower or zero-out your taxes owed, but it won't result in a refund if the credit amount is larger than your tax bill. Refundable tax credits are highly sought-after tax benefits.

If you owe fewer taxes than the credit amount, the overage will be returned to you in the form of a refund after you file your tax return. For example, if you owe $500 and qualify for a $700 refundable credit, you probably will get that extra $200 refunded to you by the IRS.The last type of credit is a middle ground between the two mentioned above.

For example, if the credit is worth $1,000, but only $500 of that is refundable, you may either have your tax liability lowered by $1,000 or get up to $500 back as a refund if taxes owed are less than the credit amount. Some of the most popular tax credits fall into three categories.

What Are Tax Credits And How Do They Differ From Tax Deductions? in San-Jose-California

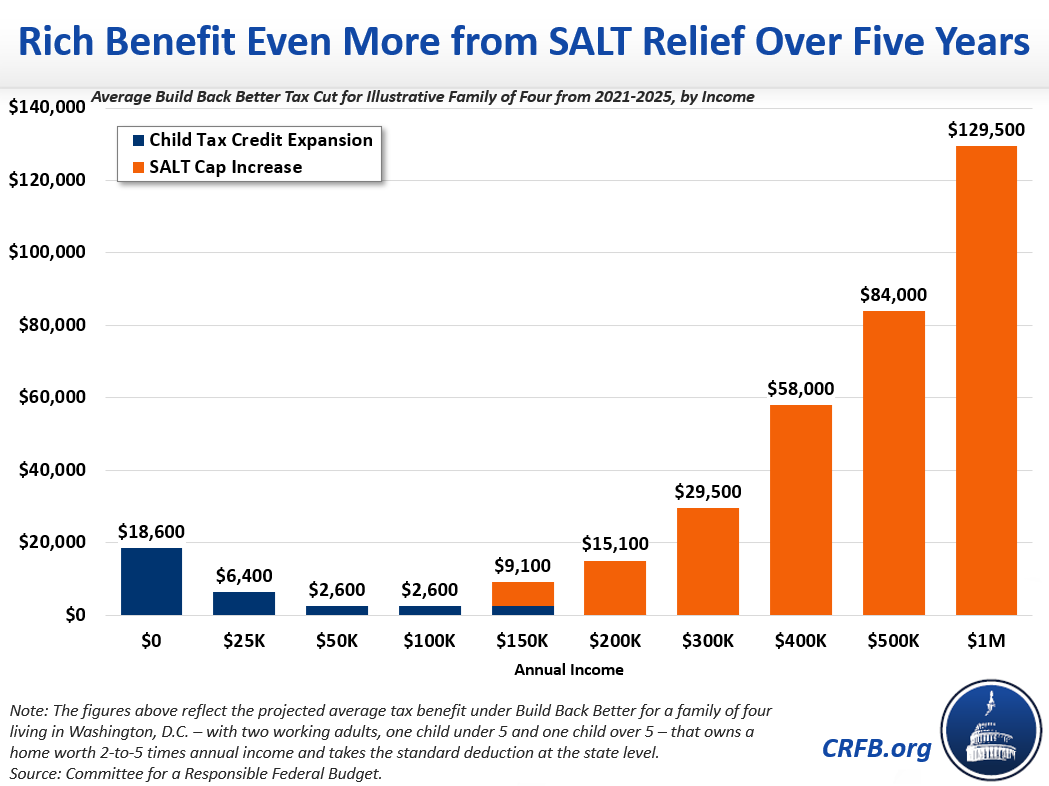

Child tax credit. For the 2022 tax year, the child tax credit could get you up to $2,000 per kid, with $1,500 being potentially refundable. The higher your income, the less you’ll qualify for. You may qualify for the full credit only if your modified adjusted gross income is under:$400,000 for those married filing jointly and $200,000 for all other filers.

Generally, the child and dependent care credit covers up to 35% of up to $3,000 of child care and similar costs for a child under 13, spouse or parent unable to care for themselves, or another dependent so you can work — and up to $6,000 of expenses for two or more dependents.

Payments made out of a dependent-care flexible spending account or other tax-advantaged program at work may reduce your credit. Earned income credit. This earned income tax credit will get you between $560 and $6,935 in tax year 2022 depending on your tax-filing status and how much you make. If your AGI was around or less than about $59,000 in 2022, it’s something to look into, though if you had more than $10,300 of investment income, dividends, capital gains and a few other things in 2022 you won’t qualify.

North Carolina Child Deduction - Ncdor in Fargo-North-Dakota

For the 2022 tax year, this covers up to $14,890 in adoption costs per child. The credit begins to phase out at $223,410 of modified adjusted gross income, and people with AGIs higher than $263,410 don’t qualify. Also, you can’t take the credit if you’re adopting your spouse’s child. People who adopt children with functional needs can get up to the full credit even if their actual expenses were less.

95 to $64. 95. Free version available for simple tax returns only. All filers get access to Xpert Assist for free. Promotion: Nerd, Wallet users get 25% off federal and state filing costs. Federal: $55 to $110. Free version available for simple tax returns only. State: $0 to $37 per state.

Federal: $59 to $119. Free version available for simple returns only; not all taxpayers qualify. State: $0 to $54 per state. Live Assisted Basic is free through March 31. Promotion: Nerd, Wallet users can save up to $15 on Turbo, Tax. Federal: $19. 95 to $49. 95 Free version available for simple tax returns only.

Tax Credits And Adjustments For Individuals in Macon-Georgia

95 per state. On-demand tax help at Premium and Self-Employed tiers. Promotion: Nerd, Wallet users get 30% off federal filing costs. Use code NERD30. The saver’s credit: The saver's credit runs 10% to 50% of up to $2,000 in contributions to an IRA, 401(k), 403(b) or certain other retirement plans ($4,000 if filing jointly).

American opportunity credit: The American opportunity tax credit runs up to $2,500 per student for tuition, activity fees, books, supplies and equipment during the first four years of college. It is partially refundable, so if the credit lowers your tax bill to $0, you can get up to 40% (limited to $1,000) back as a refund.

Parents can take the credit if they qualify and claim the student as a dependent on their return. Lifetime learning credit: The lifetime learning credit can get up to $2,000 for tuition, activity fees, books, supplies and equipment for undergraduate, graduate or even nondegree courses at accredited institutions. Unlike the American opportunity credit, there’s no workload requirement.

What You Need To Know About The 2022 One-time Tax Rebate in Tallahassee-Florida

You can claim both the American opportunity credit and the lifetime learning credit on the same tax return, but you can't claim both for the same student. Residential energy tax credits: Tax credits for energy efficiency can get you up to 30% of the cost of solar energy systems, including solar water heaters and solar panel and other home improvements.

Table of Contents

Latest Posts

Buy Best Heart Rate Monitors Of 2023 - Popular Science in LA - limited period only

Buy The 1 Thing That Will Make Every Workout More Effective in TEXAS - limited period only

Best Polar Heart Rate Monitor - H10 Vs H9 Vs Verity Sense now available in LA

Navigation

Latest Posts

Buy Best Heart Rate Monitors Of 2023 - Popular Science in LA - limited period only

Buy The 1 Thing That Will Make Every Workout More Effective in TEXAS - limited period only

Best Polar Heart Rate Monitor - H10 Vs H9 Vs Verity Sense now available in LA